App keep track of receipts

They fade, they crumple, they get lost. Receipts are slippery things. One minute they’re in your hand, the next they’ve vanished into thin air. Ever tipped out a bag or glove compartment looking for that one proof of purchase? We’ve all done it. And it always seems to happen right when you actually need it—for a warranty claim, tax deduction, or that annoying return at the store.

Now, if it’s just a coffee receipt, you shrug it off. But when it’s tied to business expenses or tax season? That’s when the stress really hits. Nothing ruins tax prep faster than a missing receipt.

Why They Still Matter

A receipt isn’t just proof you bought something. It’s the story of where your money went.

- For individuals, it’s the key to spotting spending habits. Did you really spend that much on lattes last month?

- For businesses, it’s not optional. The IRS requires proper recordkeeping, and under federal guidelines you need to hold on to receipts for at least three years (sometimes longer if deductions or audits are involved).

Here’s the kicker: nearly 97% of people say they keep some kind of financial record, but only about 1 in 10 actually store receipts digitally. That leaves most of us still buried under paper—unless we switch to an app keep track of receipts that stores everything in one place.

The Trouble With Paper

Think about your own week. Most U.S. households spend, like, over eighteen hundred bucks a week on stuff—groceries, gas, rent, bills, subscriptions, and yeah, the occasional night out. The thing is, without some system to keep track, receipts just… vanish. And those tiny little expenses? They sneak past you all the time.

For small businesses, the pain doubles. Many spend up to 10 hours a month just managing expenses. And if receipts go missing, IRS filings and tax deductions become a nightmare.

How an App Changes the Game

Using an app keep track of receipts isn’t about being tech-savvy. It’s about making life easier.

- Snap a photo when you pay, and you’re done.

- Everything gets organized for you—categories, dates, amounts.

- Need it later? Pull it up on your phone or laptop in seconds.

- At tax time, no shoebox of paper, no stress.

And the best part? Peace of mind. You don’t have to wonder if you lost something important—it’s already logged.

The Bigger Picture

The numbers make it clear. Deloitte found that companies digitizing their expense process cut manual work by as much as 70%. Another survey showed that 62% of small business owners believe better organization of finances would directly improve profitability. Add to that the fact that finance apps are growing at a 25% annual rate, and it’s obvious—paper receipts are on their way out.

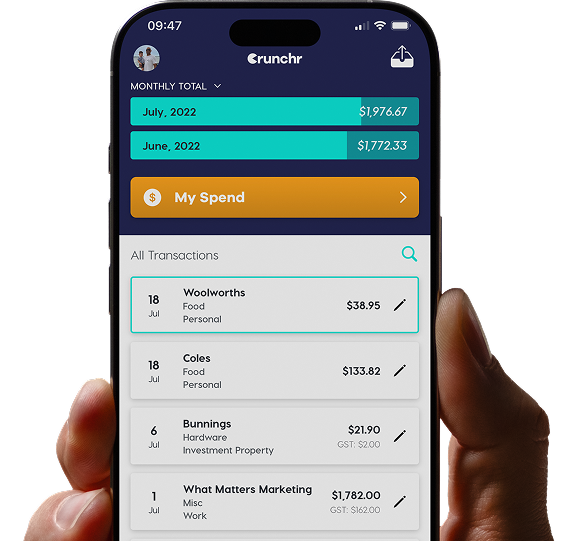

Where Crunchr Fits

This is where Crunchr comes in. It’s more than just a digital drawer for receipts. Add an expense in Crunchr and instantly you kind of get what it’s actually doing to your money. You start seeing little patterns, notice where cash is quietly slipping away, and somehow it just makes keeping track feel a bit… easier.

- Families finally get a clear picture of their weekly spending.

- Teachers can log classroom purchases without holding on to every slip.

- Contractors can track gas, tools, and supplies without paperwork slowing them down.

Crunchr turns a frustrating chore into something simple—and actually useful. With Crunchr as your go-to app keep track of receipts, you’re not just saving pieces of paper—you’re building financial clarity and confidence.