Your Burning Questions, answered

General questions

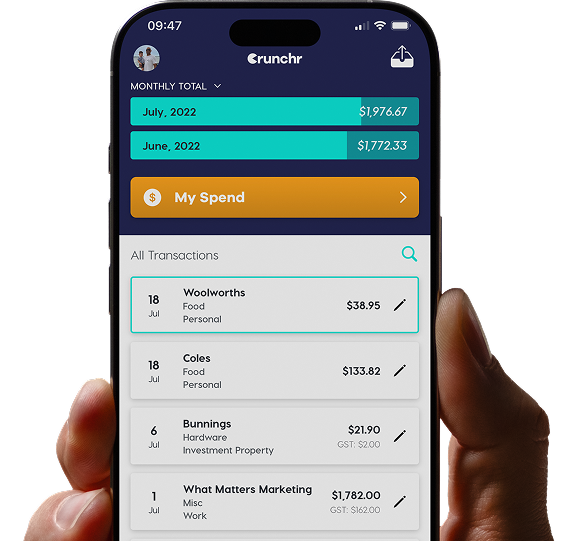

CRUNCHR does what it says it will. It’s easier to use and way more affordable. Simplicity, speed and functionality, friends.

Let us be clear, it’s not an accounting platform. It’s much simpler than that.

With its clever ability to capture, search and export, (spreadsheets with receipt photos attached) it’s your golden ticket for tax preparation, or submitting those dreaded expenses claims.

Individuals, businesses, teams! It’s designed for everyone!

You don’t even need a laptop or scanners. Just an iPhone that can take a photo or screenshot. Too easy.

Basically, if you submit a tax return (so pretty much every working human), an expense claim or if you need to put in a warranty or insurance claim, you should be using CRUNCHR. What are you waiting for?

You bet! CRUNCHR’s high-tech built-in search engine makes finding a receipt super easy. It Sherlocks through your receipt pics to find keywords, amounts, dates, folders and so on to help you find exactly what you’re looking for. Boom.

You sure can! E-receipts, PDFs, text messages, emails, photos, files. You name it, Crunchr can store it. Simply take a photo using your camera, snap a screenshot, or directly upload your file to the app.

Of Course. Every time you download a spreadsheet, a file of your receipt images can be included and sent too. So, you can have peace of mind knowing you can store your own copy of your data and receipt images, while we also back it up to our cloud for you.

Of Course. Every time you download a spreadsheet, a file of your receipt images can be included and sent too. So, you can have peace of mind knowing you can store your own copy of your data and receipt images, while we also back it up to our cloud for you.

Not at all! CRUNCHR’s smart technology can work without the help of the internet. Your data is stored on your smartphone and then automatically backs up to the cloud when you jump back onto the internet.

No worries! CRUNCHR has its own little brain, trained by accountants and powered by A.I smart technology. How cool is that? It’ll suggest a category and folder that matches your receipt information. Users also have the option to change the folder your receipt goes into — CRUNCHR will remember your changes for next time.

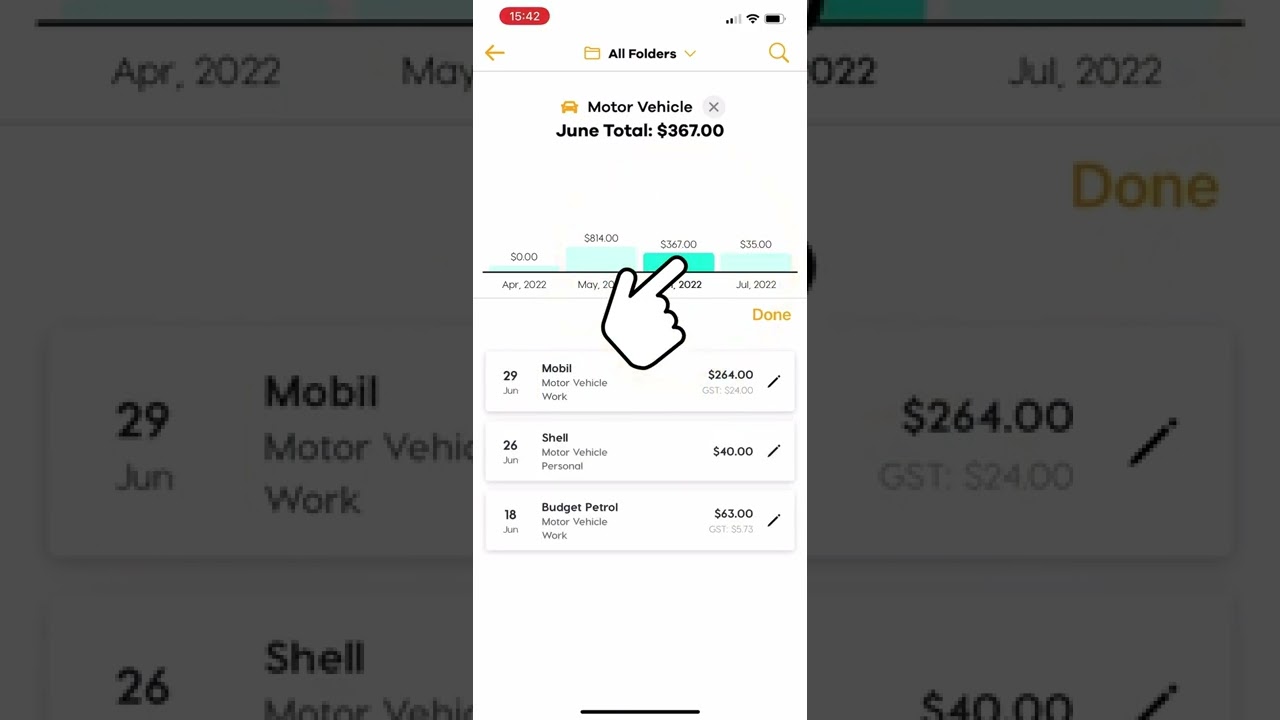

As a matter of fact, it can! CRUNCHR is a great tool to help you keep track of your expenses. The ‘My Spend’ feature even shows you how much you’ve spent on coffee (or any other expense you want to track!) from month to month. Start saving!

Not at all! Store away. You can create as many spreadsheets as you’d like. Unlimited, mate! You can even store expenses and create spreadsheets for particular jobs (any Tradies in the house?). Have an investment portfolio? You can dedicate folders and spreadsheets to that, too!

Yes! Crunchr meets the IRS’s requirements for digital recordkeeping, so you can confidently use it to track your expenses at tax time.

According to the IRS, you don’t need to keep paper receipts as long as you have “electronic copies that are a true and clear reproduction of the original.”

Receipts may vary depending on the vendor, but they should typically include:

- Vendor name

- Amount of the expense

- Description of goods or services

- Date the expense was paid

- Date of the receipt

Always check with your accountant or tax professional to ensure your records meet IRS standards.

Pro tip: Want to be extra thorough? Crunchr lets you add notes to each receipt.

*Always check with your accountant or tax professional to ensure your records meet IRS standards.

Absolutely! Whether you’re a homeowner, investor, or DIY renovator, Crunchr helps you keep your expenses organized.

Enter receipts on the go, create folders for areas like “Kitchen” or “Bathroom,” and generate individual spreadsheets for each. Track spending, create reports, and store receipts for warranties or returns—everything neatly sorted by section.

Example: Need to find the receipt for a drill you bought back in 2015? Crunchr’s smart search scans your receipts and pulls up the info in seconds. Stay audit-ready with easy access to warranties and returns too.

Both folders and categories help organize your expenses, but they’re used differently:

- Folders group expenses together by project or location. You can export individual spreadsheets for each folder—perfect for managing multiple projects.

- Categories label expenses by type (like Travel, Office Supplies, Fuel, etc.). Crunchr’s AI learns your habits and can auto-categorize your receipts for quick, hands-free logging.

Example: Working in two different cities? Create separate folders for each and use the same categories across both.

No limits! Think of Crunchr as your all-you-can-track expense buffet. Create as many folders, receipts, and spreadsheets as you want.

Have different jobs or an investment portfolio? You can create folders and spreadsheets for each one.

Crunchr’s Recurring Expenses feature (found in the side menu on Android or under Profile Settings on iOS) lets you set up repeating expenses like a monthly phone bill.

Here’s how it works:

- Crunchr automatically generates an expense on the set schedule (monthly, yearly, etc.) in your chosen folder or category

- You can attach a receipt photo later if needed

Check the “Upcoming Features” section on our website for more!

You sure can! If you need to allocate a percentage or dollar amount from one receipt across multiple categories or folders, just use the Split function when entering the receipt.

Example: Bought supplies at Walmart? You might assign $20 to your rental property folder and $30 to business expenses.

You choose the breakdown—Crunchr handles the rest.

Thanks to advanced AI, Crunchr delivers excellent accuracy when scanning receipts:

- 85% accuracy for paper receipts

- 95% for digital receipts or e-invoices

It’s always smart to double-check before saving—just in case!

Crunchr costs less than 15 cents a day—just $4.49 per month—to save you hours of stress during tax season. Not ready to commit? Try Crunchr free for a whole week!

No contracts, cancel anytime. You do the math.

Tax bonus?

Because Crunchr helps you store digital receipts, it’s generally tax-deductible* if you use it for business purposes.

*Individual or business circumstances may vary, make sure to check your circumstances with an accountant or tax professional.

It depends on how you use it:

- Business owners & sole proprietors: If you use Crunchr to track business expenses, it's typically deductible. Check with the IRS or your tax advisor.

- W-2 employees: It's a bit trickier. Software is deductible only if used for work. If you use Crunchr for both personal and business, you can usually only deduct the work-related portion.

Pro Tip: Keep those receipts—digital or paper—for any deduction claims.

Short answer? Yes.

Long answer? Still yes. If you’re reviewing spreadsheets on your iPad or tablet, we recommend exporting them as PDFs for the best viewing experience.

They sure can! When exporting from the Crunchr app, just choose the format that fits your preferred accounting software.

Can’t find yours on the list? No worries—reach out and we’ll help you out. We’re always happy to make new friends

Easy fix. Just install the Crunchr app on your new phone, log in, and your data will sync automatically from the cloud.

Yes! If you’re reviewing your spreadsheet on your phone or outside of Excel, we recommend exporting it as a PDF for the best results.

Cloud storage, baby! Crunchr stores only your most recent receipts locally for offline access. Everything else lives safely in the cloud—leaving more room for what really matters (like pictures of your pets or last night’s dinner).

Totally fine. You can cancel your account anytime. Your data stays secure unless you choose to permanently delete it.

You can also pause your account and return whenever you're ready—everything will be waiting for you.

Absolutely! Unlike some services, Crunchr lets you download all your data before canceling.

Before you go, make sure to check “Include all images” when exporting your spreadsheets so you’ve got copies of every receipt.

You can:

- Pause your subscription and return later, or

- Permanently delete your account and data