Take Control of Your Money

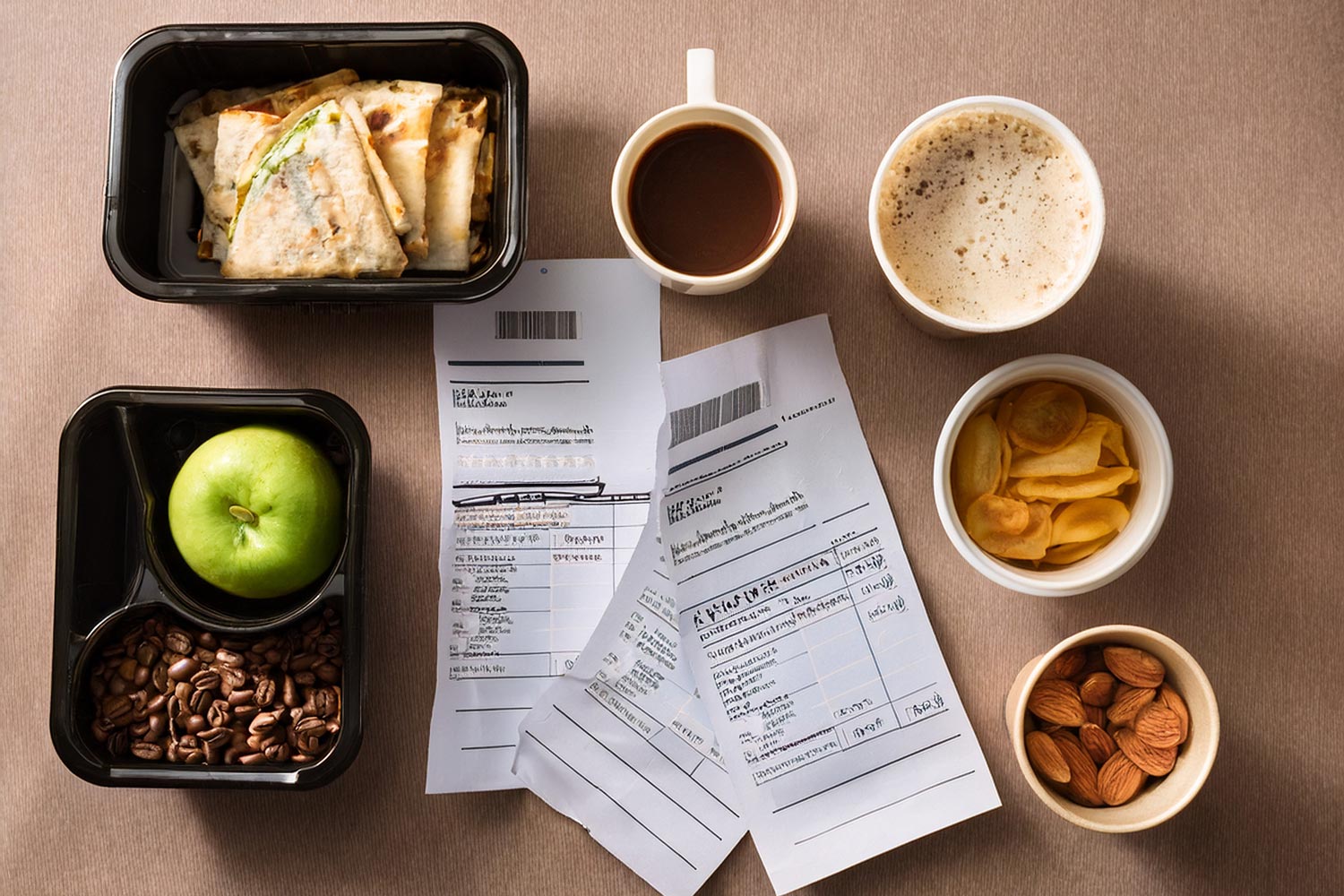

Money management sounds simple until life gets in the way. You buy lunch for a work meeting, grab coffee, pick up supplies, and before you know it, the month’s a blur. Then tax time arrives and you’re scrambling to find proof of everything. Half the receipts are gone. Some are faded. A few might be crumpled up in your bag or stuffed in a drawer.

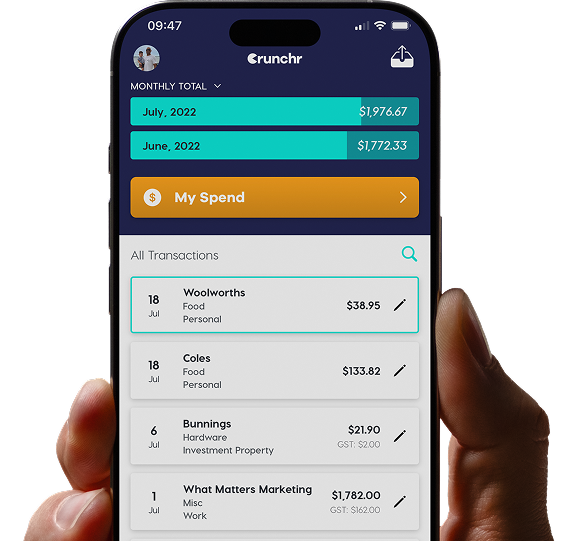

This is exactly where an expense app comes in. It’s not just another thing on your phone — think of it as a little helper that remembers all the stuff you forget. Snap a photo, save it, and just keep going. The stress? Gone.

These apps aren’t only for business owners or accountants. Anyone can use them — freelancers, teachers, students, families, whoever’s tired of losing track. The idea is simple: when you make a purchase, log it instantly. No paper piles. No guessing later.

Honestly, here’s the thing — numbers can be a bit scary, but they tell a story. Like, did you know that about 30% of small business owners miss out on deductions every year? Yeah, just because receipts vanish. Crazy, right?

So, yeah, a good app to keep receipts isn’t a luxury. It’s a smart move.

Paper is Old News

Let’s be real — paper doesn’t fit into modern life. You pay for something, and the receipt either gets tossed in your bag or disappears in the wash.

Look, it’s not really your fault. Who actually has the time or patience to hang on to every single receipt that comes their way? Not many of us. But the tax office? They don’t care about “life got busy.” No proof, no claim. Simple as that.

That’s why digital tools are winning. Grab a good expense app and snap a photo the second you buy something. Boom — done. The app keeps track of the date, the amount, even sorts it neatly into categories. No mess, no guesswork, no stress.

And when it comes to taxes? A receipt tax app is a lifesaver. It stores all your deductible expenses, keeps them organized, and hands you clean reports at the end of the year. No digging. No panic. Just data that makes sense.

One small habit — taking 5 seconds to log a receipt — can save you hours later. And in some cases, it can save you thousands.

Personal Finances Made Easy

You don’t have to be great with numbers to manage your money. You just need structure. A good app to keep receipts does most of the work for you.

How it works:

- Snap a photo every time you buy something.

- Let the app read the details.

- Review once a week.

It’s that simple. You’ll start seeing where your money goes — meals, travel, subscriptions — all clear and visual. Many users find they spend 10–15% less once they start tracking. Why? Because they see the truth.

Think about it. If you’re not tracking, you’re guessing. And guessing leads to mistakes — missed claims, overspending, frustration.

An expense app keeps you honest. It also gives you peace of mind when tax season rolls around. Instead of trying to remember what you bought last April, you’ve got every detail ready.

And for anyone serious about deductions, a receipt tax app does the heavy lifting. It separates business from personal, highlights what’s claimable, and builds instant reports.

For Businesses, It’s a Game-Changer

Running a business? Even a tiny one? Then you know how fast receipts pile up. Tracking every expense isn’t optional — it’s kind of survival. Seriously.

Small businesses spend anywhere from $1,500 to $3,000 a year just wrestling with paperwork. And that’s before you even think about the receipts that vanish into thin air. Lost proof = lost money.

This is why an expense app isn’t just nice-to-have. It’s more like a tiny, digital assistant that remembers everything for you. Snap a photo, log it, done. No more chasing people down or digging through emails.

An app to keep receipts keeps all your records in one place. Need a report for your accountant? Few taps. Done. Easy.

And come tax season? A receipt tax app saves you from the usual nightmare — mismatched totals, missing receipts, last-minute panic. You’ll feel a lot less stressed.

Some businesses that switch to digital tracking say they save up to 40 hours a month. That’s basically a whole week of work back. Think about what you could do with an extra five days.

What to Look For in the Best Expense App

Not all apps are built the same. Here’s what matters most:

- Easy to use – You shouldn’t need a manual.

- Smart scanning – Snap, save, sorted.

- Cloud backup – Lose your phone, keep your data.

- Tax-ready reports – Everything your accountant needs.

- Multi-device sync – Desktop, mobile, tablet — all linked.

If you travel or run a team, you’ll want features like multi-user access or mileage tracking. If you’re just managing personal bills, simplicity wins.

A well-designed expense app to keep receipts grows with you. Start small, then use more features as you need them.

Everyday Examples

- Freelancer: You buy software, attend events, meet clients. Each receipt matters. A receipt tax app keeps them safe so you don’t miss out on claims.

- Family budget: Groceries, school supplies, petrol — log everything. The expense app shows where your money really goes.

- Small business: Staff travel, equipment, client dinners — all logged instantly. No chasing, no stress.

It’s not about being perfect — it’s about being consistent.

The Bigger Picture

Money. Ugh. It’s tricky. Not just digits in your bank account — it’s your time, your freedom, your sleep sometimes. You know how it feels when bills pile up and you can’t even remember what you spent last week? Yeah. That.

If you actually use an expense app (and stick with it, really), something changes. You start to see the pattern. What’s coming in, what’s leaving, what’s just… disappearing. You’re not guessing anymore. Weirdly satisfying, honestly.

And receipts? Forget the paper chaos. An app to keep receipts is like that friend who remembers everything for you. Tax time rolls around, and instead of panicking, you just open the app. All there. Sorted. Deep breath.

Throw in a receipt tax app, and suddenly the scramble disappears. You’re not running around in circles looking for a crumpled receipt from six months ago. You’re calm and ahead of the game.

Summary

Look, if you’re tired of feeling messy with money or missing deductions because “life happened,” it’s time to make a change. Don’t overthink it. You don’t need a giant spreadsheet or some fancy accountant hovering over your shoulder.

Just grab an expense app, maybe add an app to keep receipts, throw a receipt tax app into the mix — and start using them. That’s pretty much it. Just stick with it, keep it simple. Do this, and money won’t feel like such a pain anymore.

Start small:

- Download an expense app.

- Use it daily.

- Build the habit.

Soon enough, you’ll see the difference. More clarity. Less stress. More money back in your pocket.

Paper is past. Digital is now. And with the right app to keep receipts and a smart receipt tax app, managing money becomes less about chaos — and more about control.