Stay on top of your finances

With simple, organized expense tracking

- Smart AI captures the receipt in seconds

- Scan and crop up to 10 receipts in one go

- Automatically categorises your spending: stationary, subscriptions, meals – whatever

One digital hub for everything

- Everything’s saved, searchable, and securely stored

- Create custom folders for your expenses – household, clients, projects

- Generate detailed expense reports that are packaged up in an instant for your accountant or clients.

Never lose a receipt again.

From groceries to gadgets, we’ve got the boring stuff handled.

- Cloud storage for warranties, returns, and tax time

- Need to find a specific receipt? Smart search locates what you need in seconds

- Crunchr learns and remembers how you like it sorted

You asked. We listened.

Bill reminders.

Don’t get stung with late fees. Tell us when you actually pay your bills and we’ll remind you when they’re coming up.

Date expected: July 2025

Crunchr email.

Stay spam-free and private with an ‘@crunchr’ email address. Plus we’ll scan receipts straight from your inbox.

Date expected: July 2025

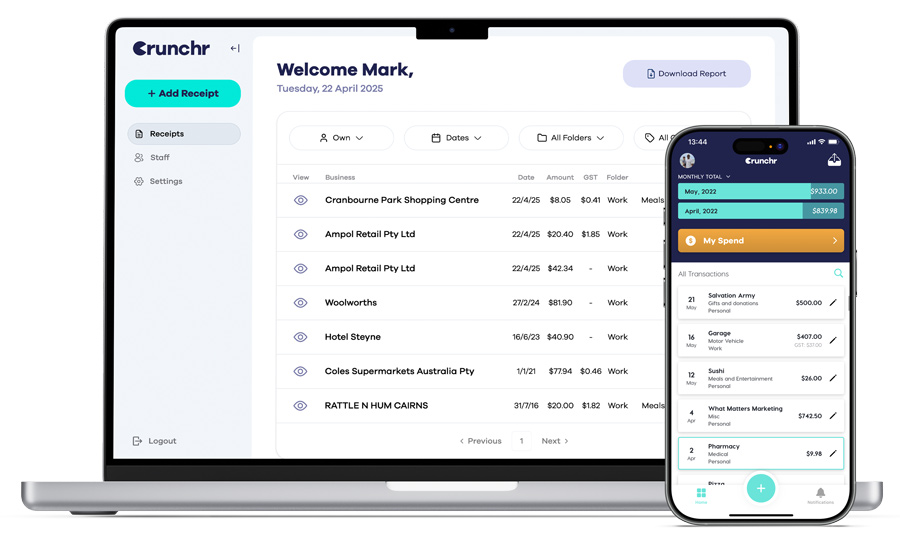

Crunchr Desktop.

Crunchr Desktop is the web version of the Crunchr mobile app, built for people who like to manage receipts and invoices from their computer. It lets you easily drag and drop or upload PDF invoices and receipt images—quick and hassle-free.

And if you’re using both the app and the desktop version, no worries—they sync automatically, so everything stays up to date no matter where you’re using it.

Split Receipts.

Whilst keeping Tax records the IRS states that you must apportion your expenses between business and private use, soon Crunchr users will be able to apportion a single expense receipt across different folders/spreadsheets

Example

Work from home – office expenses such as electricity, internet usage, when entering a bill Crunchr users can then allocate a % or $ amount to work expenses and the other % or $ amount to personal.

*Always check with your accountant or tax professional to ensure your records meet IRS standards.

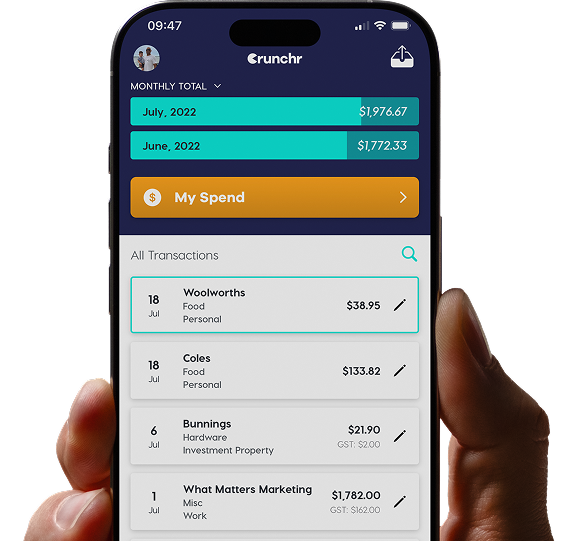

My spend calculator.

Enabling users to Crunch the numbers and calculate totals for specific categories and time ranges in seconds.

Released: 10 October 2023

Multi-page receipts.

Multi-page receipts? We got you. Snap a pic of each page Crunchr will combine them into one file.

Released: 10 October 2023

Foreign currency capability

Travelling overseas, no worries, Crunchr will soon have the capability to read and store receipts in Foreign Currencies.

Released: 12 June 2023

Android app.

Crunchr is coming to Android. The team is hard at work on development and it’ll be with you real soon.

Released: 23rd January 2023

Split Receipts.

Whilst keeping Tax records the IRS states that you must apportion your expenses between business and private use, soon Crunchr users will be able to apportion a single expense receipt across different folders/spreadsheets

Example

Work from home – office expenses such as electricity, internet usage, when entering a bill Crunchr users can then allocate a % or $ amount to work expenses and the other % or $ amount to personal.

*Always check with your accountant or tax professional to ensure your records meet IRS standards.