Ever spent ages digging through drawers or your car’s glove box, hunting for a lost receipt? You’re not the only one. Whether you’re running a side gig, a small biz, or just want to keep your personal spending in check, receipts can get messy real quick.

That’s where receipt trackers come in. By 2025, these apps have become pretty clever. They save you time, help you stress less, and even show where your money’s sneaking away. And don’t worry — no finance degree needed.

Here’s the lowdown on what they do and why they’re worth it.

What’s a Receipt Tracker Anyway?

Think of it like a digital shoebox, but way tidier. It’s an app or website where you snap pics of your receipts and keep them safe and sorted.

Most trackers let you:

- Snap a photo with your phone — no scanner fuss.

- Pull key info like dates, amounts, and store names automatically.

- Sort expenses into groups like food, travel, or supplies.

- Store everything in the cloud, so it’s safe and easy to find anytime.

Some even link up with accounting software and can handle multiple currencies.

Why Use One?

Shoeboxes full of paper are fine — until tax time hits or you wanna see where your cash’s going. A receipt tracker helps you:

- Stay organised without piles of paper.

- Snap and save receipts on the fly.

- Keep tabs on your spending habits.

- Make tax time less painful.

- Chill out knowing your finances are sorted.

Who Uses These?

- Freelancers or sole traders wanting to keep biz and personal expenses apart.

- Families tracking shared costs like groceries or holidays.

- Small businesses syncing receipts with their accounting software.

What to Look For

When choosing, ask yourself:

- Is it easy to use? Can you snap and save quick?

- Does it sort expenses automatically?

- Are your receipts safe and in the cloud?

- Can you get reports or export data easily?

- Does it connect with accounting tools like QuickBooks?

- Can more than one person use it?

Tips to Make It Work

- Get into the habit of capturing receipts right after buying.

- Use categories for better insight.

- Check your spending regularly.

- Watch out for duplicate entries.

- Pick a tracker with solid security.

Why Use Crunchr?

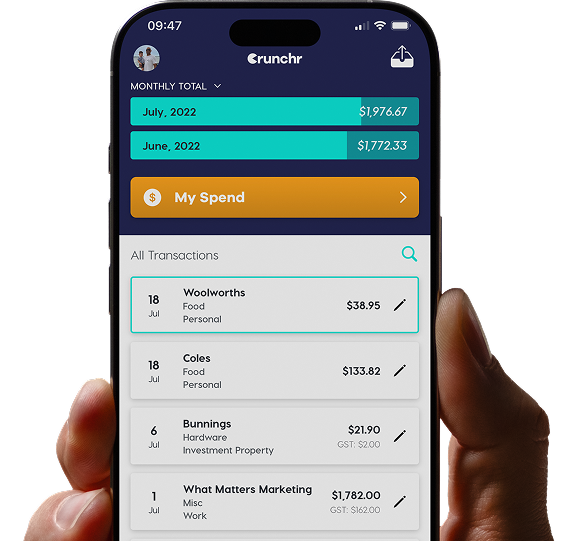

If you want something that just works — simple, easy, and reliable — Crunchr’s a solid choice. It’s made for people who don’t want to waste time fussing over receipts but still want to keep their money stuff in check.

Here’s why people like Crunchr:

- Snap a quick photo of your receipt — no scanner or extra gear needed.

- It sorts your spending automatically, so you don’t have to.

- Your receipts live in the cloud, so you can get to them from anywhere.

- Plays nicely with accounting apps you might already use.

- Super easy to get the hang of — no confusing stuff.

- Great if you’re sharing expenses with family or a small team.

- Keeps your info safe and private, with strong security.

Crunchr makes tracking receipts way less annoying. Give it a shot and see how smooth it feels.

A good receipt tracker makes money management easier. It saves time, cuts stress, and helps you see where your cash goes. There are many options out there, so find one that fits you and start today.