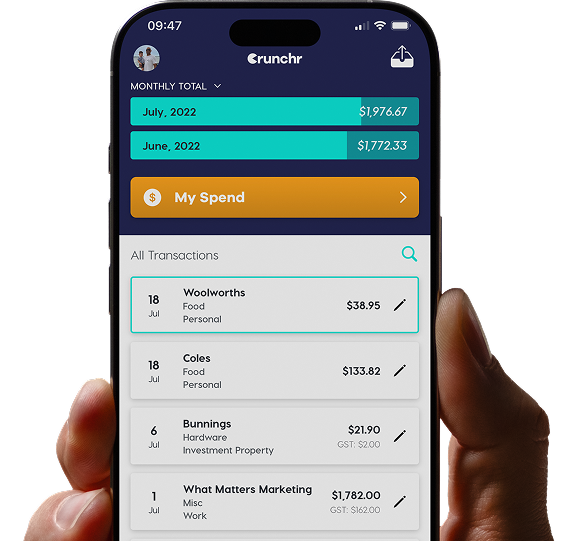

Track Your Spending

Simple budge app. Managing money seems simple—until life happens. Many believe they have a handle on their finances—but small daily expenses can add up unnoticed. Seeing income, bills, and spending in one place is tough without a tool. A simple budget app makes it obvious.

Many people still try to budget with memory, spreadsheets, or envelopes of cash. But nearly 44% of Americans don’t track their spending regularly. The result? Overspending, missed bills, and stress that could’ve been avoided with the right tool.

A budget app isn’t just another app—it’s like having a personal finance assistant. It shows you what’s happening with your money in real time. When you know exactly what’s coming in and going out, you can make smarter decisions.

The Problem With “Guessing” Your Spending

A big mistake is assuming you know your spending. Maybe you think, “I only spend $50 a week on coffee.” But without tracking, that number is probably wrong. When you don’t know your spending, a budget is basically useless.

For small businesses, the stakes are even higher. Many business owners miss deductions each year because their records aren’t accurate. They think they’re on top of expenses—but money slips through the cracks.

A simple budget app changes that. It records every transaction, sorts it automatically, and makes your finances visible. For individuals, this means fewer surprises. For businesses, it can mean the difference between profit and missed opportunities.

How a Simple Budget App Shows the Truth

A good app gives immediate insight into your spending habits:

- Real-Time Tracking – Purchases are logged automatically. No more keeping receipts or guessing later.

- Categorization – Expenses are sorted into groups like groceries, entertainment, transport, or bills. Overspending becomes obvious fast.

- Visual Reports – Charts and graphs show trends clearly. Seeing it visually is more impactful than a spreadsheet.

- Alerts – Some apps warn you when you’re close to a limit, helping you stay in control.

Think about daily lunch orders adding up to $150 a month. Over a year, that’s $1,800—money you could save or invest. A budget app makes this instantly clear.

Real-Life Examples

Personal Spending

Samantha, a 28 year old teacher, didn’t realise how much her small expenses added up. Coffee, snacks and subscriptions quietly cost her $400 each month. After tracking her spending with a budget app, she cut back and saved over $4,500 in a year.

Small Business

Ben runs a landscaping business. Receipts used to pile up in a shoebox, and deductions were often forgotten. With a budget app, he can monitor staff, fuel, and equipment instantly, turning guesses into informed decisions.

Why Manual Budgeting Often Fails

Manual budgeting can work but it’s easy to make mistakes. Life gets busy, and memory fails.

Research shows that about 72% of people who try manual budgeting fail within three months. Forgetting to log transactions or underestimating small purchases is normal.

A budget app removes mistakes. It automatically sorts expenses, calculates totals, and keeps a record. No more guessing or hunting through receipts.

Building Good Habits

- Budgeting isn’t just software—it’s behavior. A simple budget app encourages:

- Consistency – Logging daily or weekly shows spending patterns.

- Reflection – Visual trends help you cut takeaways or cancel unused subscriptions.

Business Benefits

For business owners, a budget app isn’t optional—it’s essential:

- Cash Flow Awareness – Know exactly what comes in and goes out. Avoid overdrafts.

- Expense Insights – Spot unnecessary spending.

- Tax Prep – Keep receipts organized digitally; many apps integrate with tax software.

- Team Management – Track staff expenses and reimbursements.

A small business can spend $2,000–$3,000 a year managing paperwork. Switching to a budget app saves hours weekly—time for growth, clients, or personal life.

Choosing the Right App

Look for:

- Easy to Use – Complicated apps get ignored.

- Automatic Tracking – Connects to your bank and cards.

- Custom Categories – Match spending to your life or business.

- Reports & Exports – Makes tax time easier.

- Security – Protects sensitive financial info.

Start simple, then expand as needed.

Overcoming Challenges

Even with an app, some struggle:

- Cash Logging – Take a photo or enter manually.

- Small Purchases – Track everything; snack runs add up.

- Feeling Overwhelmed – Start with one account or category, then grow.

The Psychological Edge

Tracking spending helps mentally. Knowing where money goes reduces stress and increases confidence. For businesses, clear visibility keeps owners and staff on the same page, avoiding disputes.

Getting Started

- Download a simple budget app.

- Snap receipts or log cash transactions.

- Each week check to see patterns and make adjustments.

- Set savings or spending goals.

Start small. Focus on daily habits. In weeks, you’ll know exactly where your money goes.

You can’t manage what you don’t track. Guessing brings stress and wasted money.